I learned in February’s Changing the Stories We Tell Ourselves posts that I was perpetuating negative stories to myself about who I was and what I could achieve.

Once I recognized that I was choosing to believe those stories, I was able to generate some new frameworks and tools to help navigate difficult things.

Keeping up with the monthly theme, I’m going to dedicate March’s posts to Conscious Input and Output, focusing on how I really spend my time, money, and energy, and how can I make that more efficient, comfortable, or abundant. I don’t think I could have approached this conscious input/output research a year ago, or even a month ago, because it will require me to acknowledge the truth about how I choose to use and spend my time, energy, and money.

So, all last week I tracked how I was truly spending my time, energy, and money, and I learned a lot that I’d like to share with you!

How am I Really Spending My Time?

Now, you’ve heard me say before that I’m more of a rhythm girl than a routine girl. I think that’s why Todoist and the 90 Minute Sessions work so well for me, because as long as I do the work and check it off, it doesn’t always matter when I choose to do it. I use calendars to remind myself of due dates and meetings, but I don’t fill out a daily schedule.

I always figured that as long as I was finishing my tasks, everything was good. Except…I sometimes did too many tasks just because I “had the time,” which exhausted or stressed me out. I was explicitly not conscious about how I was spending my time and energy, and so I never tried to improve the ways I approached my days.

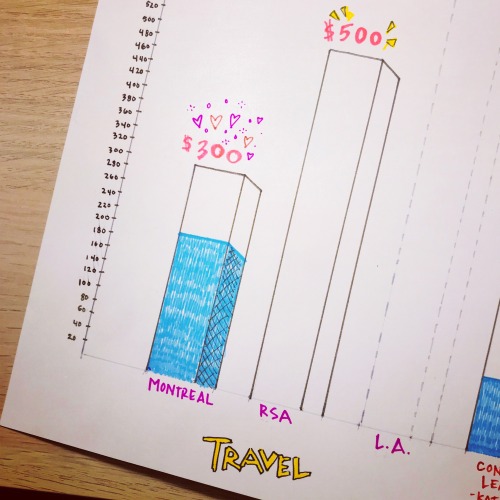

I had seen the podcast I Don’t Know How She Does It recommended at the bottom of the podcast app before, but I had never listened to it until I check out the episode “Laura Vanderkam Is a Time Management Guru.” I knew I wanted to manage my time this week, so I took Vanderkam’s advice and I broke my week up into a GoogleSheet and charted how I spent ALL of my time. I also downloaded the Sheets app to my phone so I could update my chart when I had downtime without opening my laptop. It looked like this before I filled it in with notes about how I spent each half hour:

Some blocks were easy to fill in: sleep, drive to work, bath, Facetime, lesson plan. Some blocks were a half hour stuffed full of tasks: send work email/grade some essays/prep lunch for tomorrow. There was only one block I forgot to fill in, so I put a “?” in it. I also ended up writing notes to myself at the bottom of each day’s column, such as “don’t be scared to do fun things” and “when I know how much blank space I have in a week I can give myself permission to relax.”

So What Did I Learn About My Time/Energy Output?

I Bounce Between Work & Tasks & Work

Even though I don’t work a standard 9-5 schedule, I work generally between 8am and 8pm and bounce between work and other tasks: errands, driving, appointments, and the gym.

I worked some of every day, Monday through Sunday. The amount of hours varied–some days I worked 8 hours, some days I worked 4 hours–and I usually worked in periods of 2-5 hours at a time. On Tuesday I started work at 8am and finished at 8pm, but I also ran errands, had a doctor’s appointment, and made dinner in between work sessions.

Blank Space

I didn’t have much blank space. Blank space is an idea that Kelly Exeter writes about on her blog. She gives us a suggestion on how to find blank space by not packing our days so full that we can’t have time to breathe:

Instead of using productivity to fit more stuff into our days, we need to use productivity to create pockets of space in our days where we have permission to be unproductive.

I think that social media used to fill in my permitted unproductive time, but since I only check social media 2-3 times a day for around 5-20 minutes per check, I have filled in that extra time with tasks and work. I definitely have time at the end of the day to relax, don’t get me wrong. I am sure to prioritize dinner and bath and reading as chill-out-silent-alone-time, and I also FaceTime with my sweetie when we aren’t together. I wonder if I could take some of that down time and disperse it throughout my day…

I need to work on that blank space.

Don’t Leave Tasks Til the Due Date

I realized that when I don’t finish an application or revision until the day it is due that I stress out and it really disrupts my mood and can trigger negative self talk. So, what if I plan to have the application/revision/draft done by 2 days before the due date, so I can use the day before it’s due to just do final edits? I’m currently trying this with an application that is due Wednesday. I have a final draft of my materials, and I can do final edits tomorrow and actually submit them a day EARLY. That will hopefully alleviate that stressful feeling!

How Am I Really Spending My Money?

I’ve discussed my budgeting practices here before, but this month I want to really dig into spending and saving.

Set Some Rules

I recently finished the audiobook for Cait Flander’s The Year of Less. It was amazing! Cait is one of the co-hosts for one of my favorite podcasts, Honest Money Conversations. Cait describes in her memoir her experience with a shopping ban and intentionally mindful shopping. While I’m not going to put myself on a full blown shopping ban, I am going to set a few spending rules this month:

- Track how I spend my money (including how I designate my savings) by writing it down in the same spreadsheet where I track how I’m spending my time. I’ll write how much I spent, where, and what at the bottom of each column (i.e., “$20 on gas” or “$45 dollars at Target on toiletries”)

- Don’t purchase these things: books (including audiobooks), candles, online shopping for items that aren’t gifts. Books will be hard, because I read in the bath and sometimes I get the books wet, but I’m going to try reading library books very carefully. Wish me luck!

- Only spend $30 per trip at fancy grocery stores like Whole Foods or the Coop, and buy groceries at other places that are cheaper.

Be Creative

I listened to the “Getting Creative with Money” episode of Honest Money Conversations, and I learned a new savings tool: mapping. Cait and Carrie talked about how people will color in pictures that designate their savings goals, and I wanted to try it out, too (for free). My sweetie is creative and talented, so I asked her to help draw me up a chart to keep track of my savings and my debt pay off.

I wanted a visual report of my savings/debt payoff for three reasons:

- Once I put money into a savings account, I didn’t want to take it out. If I had colored in a part of the chart, I knew my Obliger self wouldn’t take money out of that account.

- I didn’t want to have to log into my bank and credit card accounts every time I wanted to check my savings/payment levels.

- It would motivate me to save more and pay off more debt, and would make me feel proud.

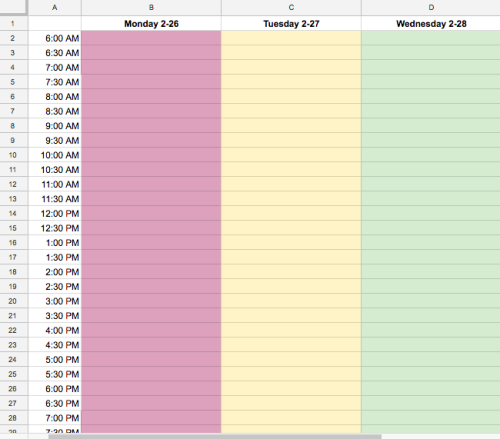

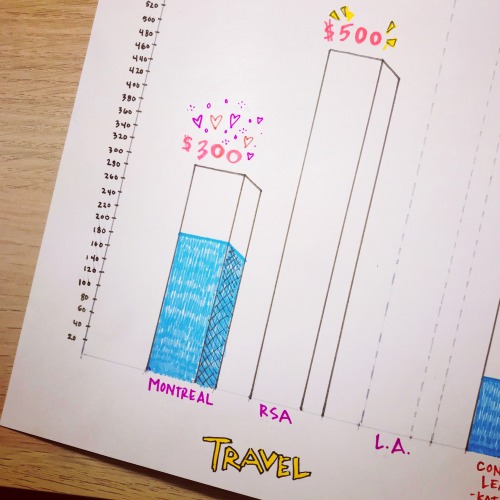

Sweetie made me a chart with three levels. The first is has increments of $20–this is for travel and learning; the second has increments of $200–this is for paying off credit card debt; the third has increments of $500–this is for my “Feminist Fuck Off Fund” (emergency fund), and my savings for summer.

As you can see, I broke my travel savings up into a few parts to reflect what I still need to save for the trips (this does not include things I already paid for, like hotels, travel, registration, etc.). Here’s that picture again:

Montreal is for a vacation with my Sweetie, and RSA is for remaining expenses to go to the Rhetoric Society of America Conference in June. L.A. stands for a trip to Los Angeles to see my best friend and to visit the archives for my research. I’m waiting to hear if I got a research fellowship, which will affect my travel plans and my travel budget, so right now there’s no cap for how much I should save or when it’s due.

The rest of my $20 increment bar chart includes savings for Continuous Learning (you can see Kate Snowise’s next workshop series peeking in the photo above. Kate: I already have saved $100 bucks for it!).

When I save money, I get to color in the chart. I’ll keep posting about my progress!

So What Did I Learn About My Money Output?

By the end of a long day where I was up at 6AM and don’t finish until 8PM, or on a day where I have been working on a high stakes project for a deadline, I do not want to cook but I do want food that takes more energy to prepare than pouring a bowl of cereal.

I spent money last week on takeout, but I don’t regret it. The way I see it, the issue comes from when I buy food to cook and don’t cook it and it ends up being wasted because I didn’t have the energy to cook and so I got takeout instead. I’d like to streamline cooking/getting takeout in a way that is the best expenditure of my time, energy, and money. Maybe I’ll literally schedule out meals for slower days and take out for busier days.

Maybe you already use a planner to the T, or maybe you’re like me and you have a “just so it gets done” mindset. Regardless of your particular style of spending your time/energy/money, I really would recommend making a spreadsheet. Even if it’s just for a day. I know it sounds like it’s going to be too much work, but in my opinion the payoff is illuminating (or at least interesting).

Track how you spend your time. Are you spending more and/or less time on tasks than you thought you had? Are you taking breaks?

Track how you spend your money. Where is your money going? Are you okay with that? How could you change it?

Track when you feel most stressed or under pressure. Is there a pattern? How could you change it?

Track your blank space. If there isn’t any, where can you build some in? It could be a walk around the block or time to check out Instagram for a half hour.

*Please note that the original version of this blog post was published here.

newsletter and free resources

Sign up below to access six free resources and my newsletter, tending.